- sales@goldenleadership.net

- +966 544341670

- Working Hours : Saturday - Thursday , 7.30 am to 5.30pm

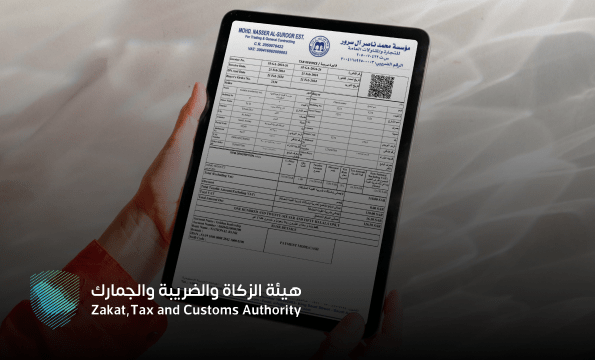

E invoice

What is E invoice ?

E-Invoice invoice that is issued, saved, modified, and sent in electronic form via an electronic system (for example, but not limited to, a handwritten invoice that is scanned is not an electronic invoice). An electronic invoice is concerned with tax invoices that are usually issued as a main commercial document to indicate the goods and services provided to the customer and to request or prove the amounts to be paid for those goods and services. Since the electronic invoice is a tax invoice, it must contain all the requirements of the basic tax invoice

E-invoice Requirements

Maintaining Records And Data

- A taxable person must keep invoices, records and accounting documents for at least 6 years from the end of the tax period.

- Records must be kept and all invoices issued in Arabic.

- The logs must be saved to a server that allows access to those logs.

- Take security measures that enable data checking and prevent tampering.

- The Authority has the right to review the systems and programs used by the taxable person in preparing his accounts.

Compliance Requirements

- The ability to connect to the Internet

- Connectable to external systems using an application programming interface (API)

- It is not subject to tampering and should include a mechanism that detects any tampering that may occur on the system by the user or any other party. (anti-tampering).

- Comply with the requirements and controls of data, information, or cyber security in the Kingdom